Switzerland | Online shopping in our webshop | Own German delivery address or Grenzpost.de

Good exchange rates and sometimes strong price differences between Switzerland and Germany make shopping in the area near the German border very attractive. An order in our webshop therefore comes with many advantages.

If you have your own German delivery address, you can specify this as the delivery address in the ordering process.

If you do not have a delivery address in Germany, you can use the affordable service at www.borderpost.de.

With www. Grenzpost.de as a German delivery address As a Swiss citizen, you now have the opportunity to shop easily and safely on our German websites. Since the delivery within Germany is delivered to a border post office, there are great advantages compared to ordering directly to Switzerland.

The Shipping to Switzerland always costs €39,00 because we always have one fee-based export declaration have to carry out. For an order value of over € 1000,00 even a more expensive one, separate export declaration. After receipt you only have to pay the Swiss VAT No other costs !

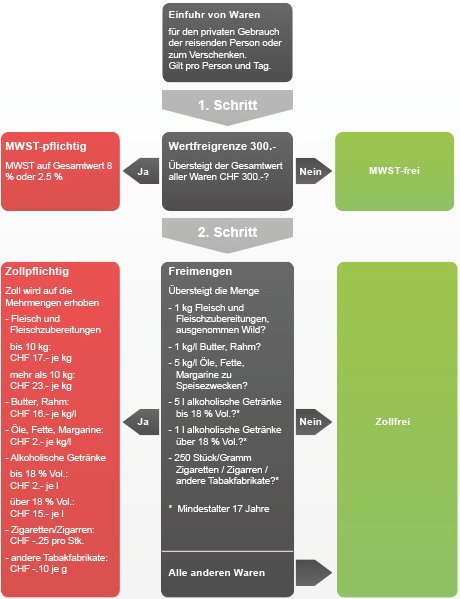

The biggest advantage of having a delivery address in Germany is usually very low shipping costs within the EU, the Shipping time of just a single working day and the Value-free limit for non-commercial travel. Goods worth 300 CHF (Value-free limit) can be carried tax-free. If the value exceeds this, you are obliged to pay Swiss VAT, However, our products are always duty-free, but not VAT-free if the value-free limit is exceeded.

Short video | How does www. Grenzpost.de work?

Duty-free imports for travel purposes

We have summarized current and detailed information on the rights and obligations regarding customs clearance as follows. More detailed information can be found on the Swiss Federal Customs Administration website.

When you enter Switzerland, personal effects, travel provisions and fuel in the tank of your vehicle are tax-free. For the other goods carried, VAT (from 300 francs) and customs duties are charged depending on their total value. However, tariffs are only imposed on food, tobacco, alcohol and fuel. Please note that not all goods may be imported. For more information, see Prohibitions and Restrictions.

Duty-free goods

When you return from abroad or when you travel to Switzerland, you are allowed to import the following goods duty-free:

Personal items

This includes everyday items that:

- took people living in Switzerland with them when they left the country;

- people living abroad can use and take away again during their stay in Switzerland. This includes, for example, clothes, laundry, toiletries, sports equipment, photo, film and video cameras, mobile phones, portable computers and musical instruments.

Reiseproviant

Ready-to-eat foods and non-alcoholic drinks for the day of travel.

Treibstoff

Fuel that is in the tank of private vehicles is tax-free. Additional fuel (e.g. in reserve canisters) is also tax-free up to a maximum of 25 liters. The allowances are only granted once per vehicle per day. More information